Get the free protective life insurance company claimant's statement form

Get, Create, Make and Sign

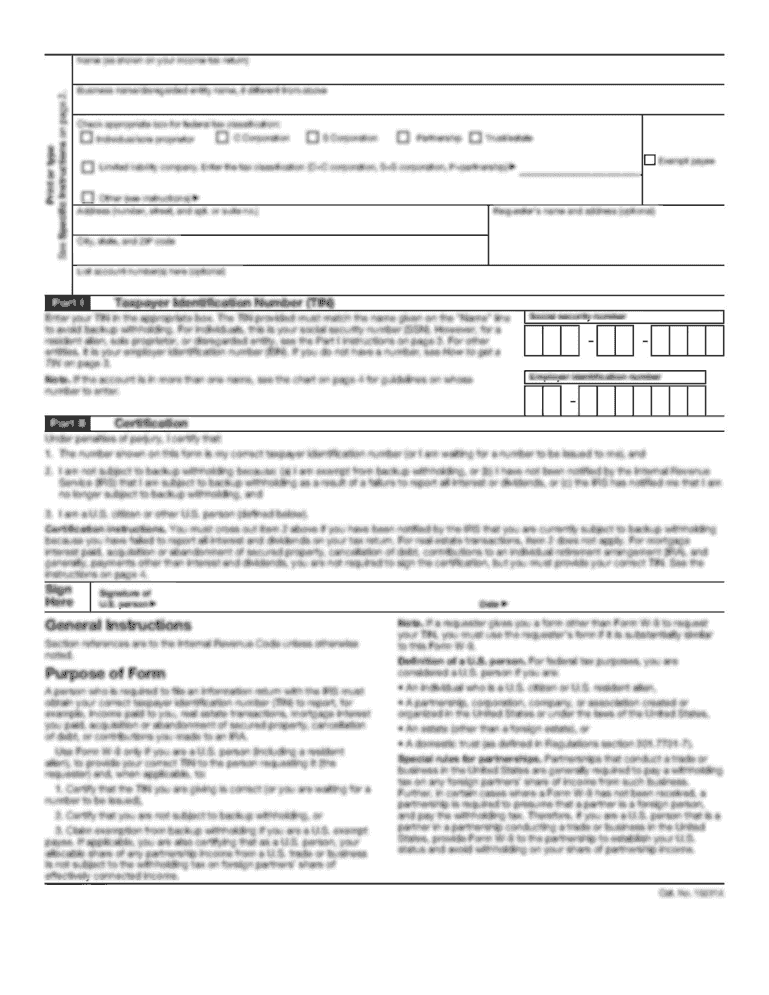

How to edit protective life insurance company claimant's statement online

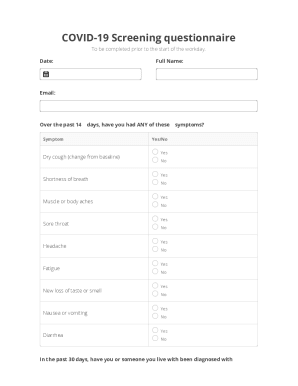

How to fill out protective life insurance company

How to fill out claimant statement prosperity life?

Who needs claimant statement prosperity life?

Video instructions and help with filling out and completing protective life insurance company claimant's statement

Instructions and Help about american heritage life claimant's statement form

Disability insurance claim and statements are required by just about every disability insurance carrier on either a monthly basis bimonthly semi six times a year or yearly it just depends on what type of claim you have and how long you been on claim but what I want to talk about today with attorney Stephen Jess up is why are the disability carriers asking for these claimant statements and let's also talk a little about what types of things that a claimant needs to look out for in these disability claimants statements well I think first and foremost the reason why they're requesting them is they want to hear from you and your own words as to why you can't work what you are doing what your restrictions and limitations are, so they're trying to get to know you better a moral Tara motive with that would be the fact that a lot of times informs people say well I can't do this I can't do that I can't do X Y or Z whatever the case may be then if the insurance company does video surveillance at a later point they're going to take what you've you know represented to them as to what you're able to do and see if what they catch independently if those things start to you know if they coincide so if there's any indiscretion or in discrepancies in those forms the carrier could use it against you as a way to try to deny the claim right so in every single disability insurance claim and form i always tell that my clients that whenever you fill that form out you have to assume that the disability insurance company knows exactly what you're doing and what you've been doing so don't think that you're going to you know say put something down, and they're not going to figure out that actually yeah you do ride your bike, or you do go to the gym if you do it's fine just don't tell them that you don't do something, and then they see you doing it because that's going to be a big problem what about the fact that a lot of these claimants statements give you like one or two lines to put down the information in terms of how you're spending your days or for example why what things can you not do from your job well I think the big thing and the hardest is you'll see people when we get claim files wherever the case may be that actually try to squish it all in those two lines as a ploy as opposed to you know writing an addendum on or attachment where you explain more I think you have to be careful being you know overly verbose, or you know too in depth as to what's going because they will use it against you, but you also don't want to because of give me only two lines overlooked important parts of you know your claim or your condition in an effort just to get it in those two lines right, and I know that you know we fill our hundreds of claim forms every month on behalf of our clients and are always reviewing them, but you know one of the big problems and i think the traps that a lot of claimants fall into is that their medical records don't match the restrictions of limitations...

Fill manhattan life beneficiary claimant statement : Try Risk Free

People Also Ask about protective life insurance company claimant's statement

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your protective life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.